February 2nd: Anchoring, Managed Futures, and Robo-Analysts

Welcome to Quant Digest - a weekly newsletter that provides high quality content related to factor investing. Subscribe to get access to the website and ensure you never miss a release.

Research

Anchoring on Past Fundamentals - Doron Avramov, Guy Kaplanski, and Avanidhar Subrahmanyam

“Deviations of accounting fundamentals from their preceding means strongly predict future equity returns in the cross-section. Comprehensive measures based on such deviations yield annualized alphas that generally exceed 15% (6%) for equal- (value-) weighted portfolios. The return predictability goes beyond momentum, 52-week highs, profitability, and other prominent anomalies. The deviation-based investment profitability applies strongly to the long-leg and survives value weighting and excluding microcaps, unlike for other well-known return predictors. We provide evidence that the predictability arises because investors underreact to deviations from prevailing fundamental anchors.”

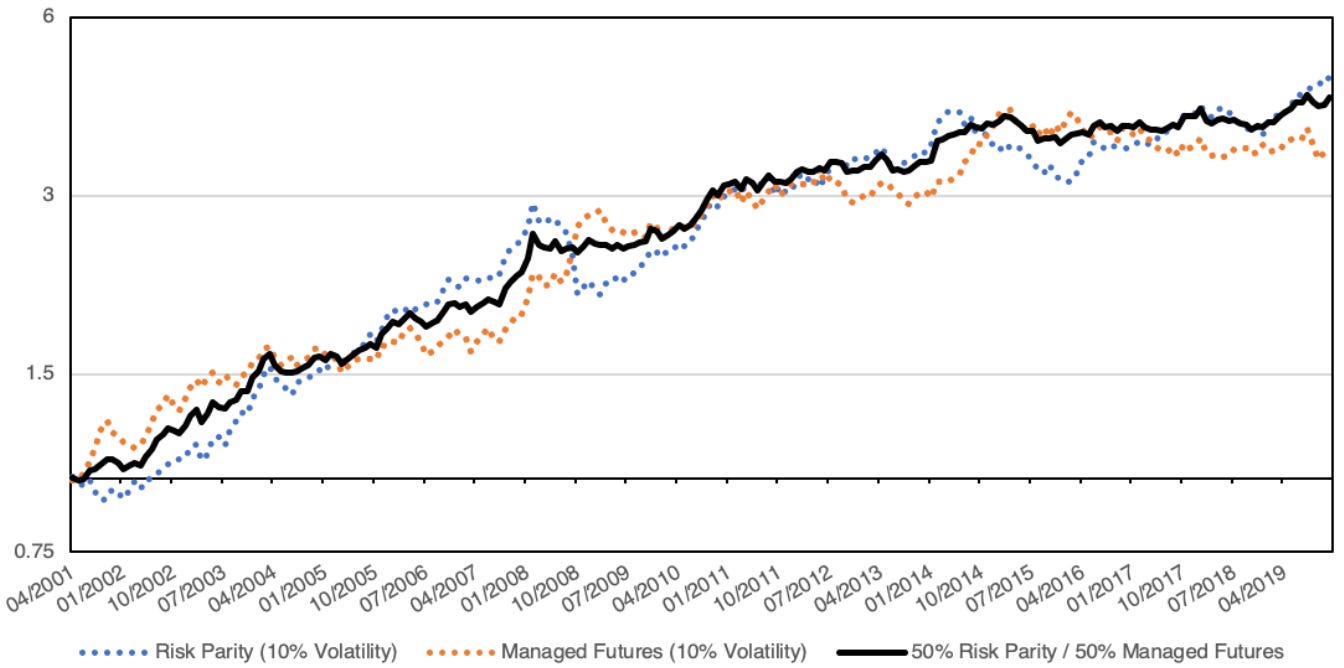

Can Managed Futures Offset Equity Losses? - Corey Hoffstein

“In this research note, we sought to explore this concept by generating a large number of managed futures strategies that varied in the number of contracts traded. We found that increasing the number of contracts had two primary effects: (1) it reduced realized convexity from a “smile” to a “smirk” (i.e. exhibited less up-side participation with equity markets); and (2) meaningfully increased returns during negative equity markets […] Therefore, employing managed futures specifically as a strategy to provide offsetting returns during an equity market crisis requires the belief that a sufficient number of other exposures (i.e. equity indices, rates, commodities, and currencies) will be exhibiting meaningful trends at the same time.”

Shareholder Satisfaction with Overlapping Directors - Rachel Li and Miriam Schwartz-Ziv

“Mutual fund shareholders are particularly supportive of “overlapping directors”—directors who serve simultaneously on a corporate board and a mutual fund board. Such support is observed on behalf of both connected funds (sharing a director with the company) and non-connected funds (not sharing a director with the company), and is particularly prominent when monitoring is needed. Our results suggest that the benefits offered by overlapping directors to all fund shareholders exceed the costs arising from their potential conflicts of interest, and that the benefits they offer are more valuable to mutual fund shareholders than to other types of shareholders.”

Social Transmission Bias in Economics and Finance: Transcript of the AFA Presidential Address with Presentation Slides American Finance Association 2020 Annual Meetings - David A. Hirshleifer

“I discuss an intellectual revolution, social economics and finance: the study of the social processes that shape economic thinking and behavior. This emerging field recognizes that people observe and talk to each other. A key, underexploited building block of social economics and finance is social transmission bias: a systematic directional shift in signals or ideas in social transactions. I use five “fables” (models) to illustrate the novelty and scope of the transmission bias approach, and offer several emergent themes. For example, social transmission bias compounds recursively, which can help explain booms, bubbles, return anomalies, and swings in economic sentiment.”

Man Versus Machine: A Comparison of Robo-Analyst and Traditional Research Analyst Investment Recommendations - Braiden Coleman, Kenneth Merkley, and Joseph Pacelli

“Our study provides the first comprehensive analysis of the properties of investment recommendations generated by “Robo-Analysts” […] portfolios formed based on the buy recommendations of Robo-Analysts appear to outperform those of human analysts, suggesting that their buy calls are more profitable. Overall, our results suggest that Robo-Analysts are a valuable, alternative information intermediary to traditional sell-side analysts.”

Blogs + News

The Impact of Crowding on Alternative Risk Premia Investing - Alpha Architect

Can Factor Returns Be Improved via Big Data? - Factor Research

The Perils of Parameterization - Bloomberg

50 Cognitive Biases in the Modern World - Visual Capitalist

AQR Says to Get Sober About Future Returns - Institutional Investor

How Do Minimum Liquidity Requirements Impact Factor Returns? - Factor Research

Sixteen Leading Quants Imagine the Next Decade in Global Finance - Bloomberg

Buy & Hold with Tactical, A “Lethargic” Asset Allocation Approach - Allocate Smartly

Development of the Black-Scholes formula: Theory, research and practice - Bloomberg

Quantitative Analytics: Optimal Portfolio Allocation - R Shenanigans

Ken French ‘No Way to Tell’ If Value Premium Is Disappearing - Institutional Investor

Low Volatility-Momentum Factor Investing Portfolios - Alpha Architect

Quants Say They Can Make Investing More Sustainable - Bloomberg

Fighting U.S. FOMO - Newfound Research

Podcasts

Chris Schindler - The Alternative to Alternative Risk Premia - ReSolve AM

Christopher Davis Discusses Smart Value Investing - Masters in Business

A History of 5 U.S. Market Crashes with Scott Nations - We Study Billionaires

Tweet of the Week

Might be cheating with the time range but felt appropriate after Super Bowl Sunday!

Conferences

Asset Management Derivatives Forum 2020 - Dana Point, CA, 2/5-2/7

Bloomberg Quant Seminar Series - New York, 2/19

2020 Consortium on Asset Management, FMA - Cambridge University, 2/24

Thanks for reading!

Send anything worthy of future inclusion to quantdigest@gmail.com